Unifinanz is aware of its responsibility to ensure a future worth living for the next generations. Sustainability, including the promotion of a sustainable environment in the environmental, social, and economic areas, is firmly anchored in our corporate strategy.

We’ve set ourselves ambitious goals for the future, both for the company and at the asset investment level, and are thus actively trying to contribute to the achievement of the 17 Sustainable Development Goals (SDGs) of the United Nations.

For Unifinanz, responsible business activity is a matter of course. We’ve decided to focus on sustainability within the product and service universe. Over the last few years, various steps have been taken to ensure that processes are in place to meet this requirement. The adoption in January 2022 of the new business strategy that was conceived several years ago means the courses of action it entails will now be implemented step by step.

Sustainability-related disclosures

Our comments on Articles 3, 4 and 5 SFDR can be found under the following link:

Sustainability-related disclosures (PDF download)

The concept of sustainability

ESG

In line with the European Union's understanding of sustainability, sustainability is not to be limited to environmental aspects but should take into account the entire ESG spectrum (Environment, Social and Governance). ESG is a term used to describe a range of opportunities and risks and selected underlying indicators.

SDG

In addition to the term ESG, the so-called 17 Sustainable Development Goals (SDGs) of the United Nations are also on everyone's mind. The 17 SDGs are political goals of the United Nations (UN) that are intended to ensure sustainable development worldwide at the economic, social and ecological levels. They were designed along the lines of the development process for the Millennium Development Goals (MDGs) and came into force on 1 January 2016 with a duration of 15 years (until 2030). Unlike the MDGs, which particularly applied to developing countries, the SDGs apply to all states.

More and more companies are aligning themselves not only with ESG factors but also with the overarching themes of the 17 SDGs. The availability and transparency of data in this area is increasing all the time, especially as more and more investors are demanding that the data be taken into account and that compliance be monitored. Below we give you an overview of the 17 objectives.

Influence on financial market participants

The influences on financial market participants, especially on investment firms, but also on larger companies, are extensive and multi-layered. In addition to disclosure requirements from the Sustainable Finance Discosure Regulation (SFDR), the topic of sustainability is also taken into account in MiFID II and thus also in the advisory procedure for clients.

Meaning for you?

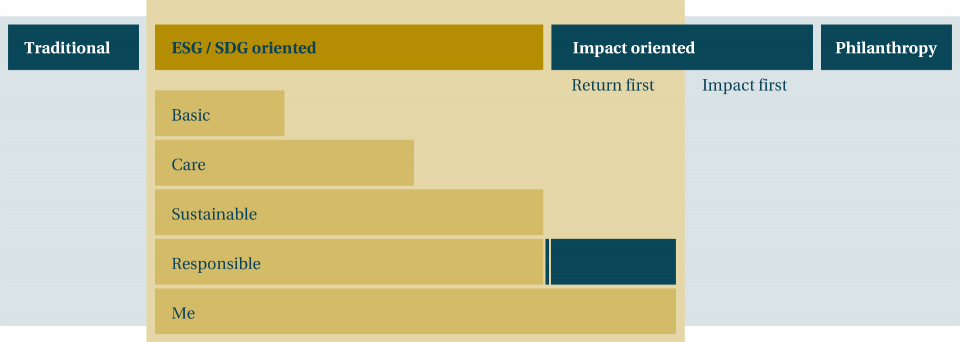

You and we are also in a position to support the goals of the United Nations in the context of asset investment. Unifinanz is committed to integrating sustainability preferences. With the implementation of a ‘Basic Package’, Unifinanz follows at least an ESG integration approach, regardless of a client's personal preferences. Clients may also claim other packages concerned with sustainability aspects. Unifinanz pursues a modular structure, which also allows a high degree of customisation if required (Me package).

Our approach

Unifinanz basically offers four package solutions as well as the possibility of individualisation (Me) for the implementation of sustainability preferences.

- Basic | ESG integration according to Unifinanz model (minimum standard for all mandates)

We exclude those companies from our investment universe that have a poor ESG rating.

- Care | Norm-Based Research / Exclusion criteria

We’re able to take into account the UN Global Compact criteria in asset allocation, for example, or to exclude certain topics (such as controversial weapons).

- Sustainable | Focus on ESG / SDG consideration

This gives you the opportunity to invest more in companies that have a strong focus on supporting the United Nations goals and making a positive SDG contribution.

- Responsible | Focus on Involvement / Engagement

Engagement and proxy voting service packages allow you to indirectly influence company policy. Through our data provider, we can offer efficient participation procedures according to certain packages, which, for example, allow you to always follow a certain standard when voting.

- Me | Individual package

All available modules can be customised. We can reflect your personal needs in the portfolio construction.

Implementation

We support you holistically in dealing with issues related to the implementation of sustainability preferences. We use a systematic process design to accompany you (depending on the given initial situation) from investor profiling to the definition of principles and their effects (by means of scenario analyses and advice on implementation variants) to effective implementation.

Sustainability preferences can be implemented step by step whether you are only intending to invest or have already done so.

Monitoring and reporting

Besides support in implementing sustainability preferences in Asset Management, you will receive comprehensive support in monitoring and reporting topics. Depending on your needs, we can provide you with the following reports in particular:

-

ESG Rating Portfolio Report

-

SDG Impact Rating and Solutions Portfolio Report

-

SFDR Portfolio Report

-

EU Taxonomy Alignment Report

-

Climate Equity Report

-

Carbon Footprint Report

Your choice of package and the resulting ideas and wishes regarding the integration of sustainability are also continuously monitored using our controlling and portfolio management software.

Entrepreneurial aspects

What is being implemented at Unifinanz level?

By integrating ‘sustainability’ into its business strategy, Unifinanz has laid the foundation for systematically and comprehensively considering sustainability and climate aspects during its business activities, which will now be further expanded step by step.

By adopting the new business concept, Unifinanz has defined various measures that will lead the company even closer to effectively integrating ESG criteria and the support of the 17 SDGs (Sustainable Development Goals) defined by the United Nations. These measures will be increasingly applied to corporate governance, the service landscape, human resource management, and the business operations themselves (including processes). Anchoring this in the business concept will consistently encourage the commitment to these areas for a more sustainable and responsible future.

Furthermore, Unifinanz already supports (for example) a 100% non-profit foundation whose purpose is exclusively geared towards supporting the 17 SDGs of the United Nations.

Sustainable investing

How can sustainability preferences be implemented in Asset Management?

There are different ways to integrate sustainability preferences into Asset Management. We’ve opted for a modular approach with thematic differentiation features. This favours a systematic application of the implementation options listed below.

- Basic | ESG Integration according to Unifinanz Model

- Care | Standards-based / Exclusion criteria

- Sustainable | strong focus on ESG / SDG consideration

- Responsible | strong focus on involvement / engagement

- Me | Individual package

Through this approach, sustainability aspects can be added to existing investments as well as new designs.

Learn more about our range of services in the field of sustainability. We look forward to hearing from you.

Implications for the investment system

How does the topic of ‘sustainability’ affect the investment system?

In a holistic view, integrating sustainability into Asset Management entails changes in the entire investment system of an investment company. Accordingly, targeted measures were taken at Unifinanz and changes were made to the investment policy, the investment universe, strategies, advisory procedures, portfolio management, risk management, customer service, reporting, and other areas.

In addition, the associated processes were adapted by means of clear responsibilities and with the help of external partners (data providers).

These procedures are periodically adjusted in view of ongoing regulatory developments.